Battalion Holdings is a private capital, real estate, and entertainment investment firm

— built to acquire, develop, and manage multifamily assets, media film projects, and high-growth ventures across the U.S. and European markets.

Preparation builds confidence. Confidence shapes excellence. Excellence sustains control.

Control mitigates risk.

That’s not just a quote — it’s the operating system of Battalion Holdings.

We don’t just build properties

— We move beyond buildings

— we build empires.

Battalion Holdings blends real estate, media, screenplays, & markets to create assets that perform and stories that inspire.

💼 Private Placement Memorandums,

💰 Key Man Insurance,

📈 Public Listings & Bonds,

🧠 fully compliant growth systems that scale globally.

BATTALION HOLDINGS

🚀 Battalion Holdings operates under Regulation 506(c)

— allowing us to partner with accredited investors nationwide.

Why Investors Choose Battalion Holdings:

🤝100% transparency in reporting and asset performance Quarterly investor updates Direct access to deal-level documentation Co-investment from leadership ensures full alignment

💰 We don’t chase hype — we build value.

GROUP INC

🌍We focus on multifamily and mixed-use properties in emerging markets with strong job growth, population inflow, and long-term rental demand.

📍Our Process: Identify undervalued assets or development opportunities. Enhance value through renovation, repositioning, or optimized management. Preferred Asset Classes: Multifamily, Workforce Housing, Build-to-Rent

💰 Deliver stable cash flow and appreciation to our investors.

Target IRR: 14–18%

Hold Period: 5–7 years

📊 Real Assets. Real Returns. Real Impact. Real People.

🛡️We now have a team that speaks: English Spanish Portuguese and Russian Book a time SLot

🤝 Private Equity & Funding

— “Capital Meets Vision”

⚡Through Battalion Capital Partners, our private equity division, we collaborate with boutiques and institutional partners to raise and deploy funds efficiently.

We structure deals that meet investor goals — whether it’s consistent cash flow, tax-advantaged equity, or long-term appreciation.

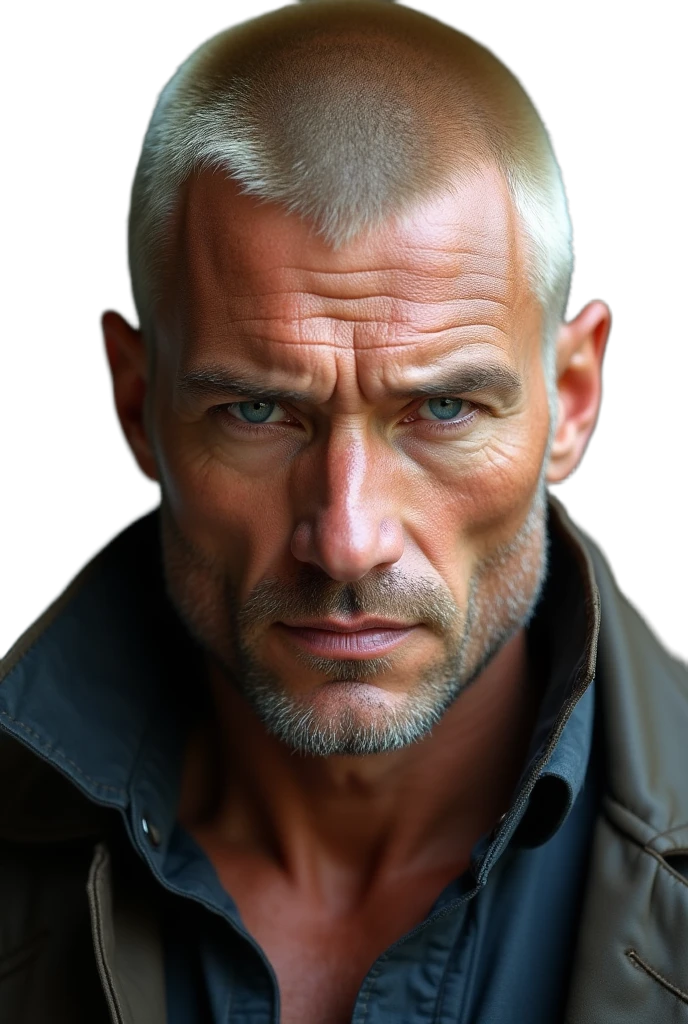

👤 Leadership — “Command Through Experience”

Meet Our Leadership Team

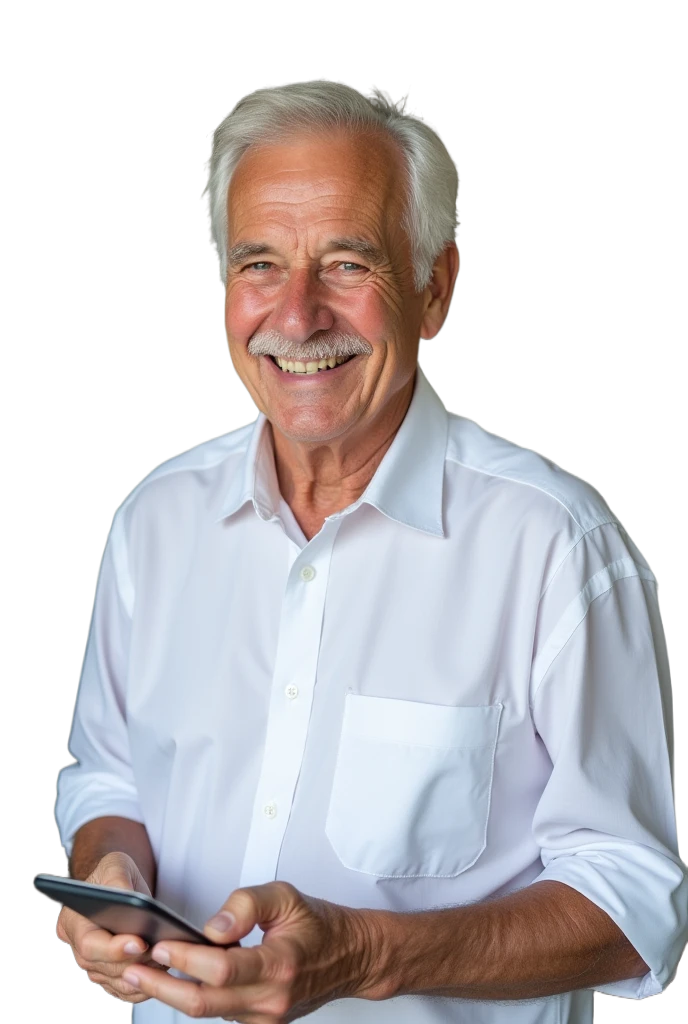

Doctor Bill Neil – North American (Sales Master)

Background: With over four decades of experience Dr. Bill Neal brings structure, ethics, and precision to every investment portfolio he touches.

In his early 60s, Dr. BiLL has personally managed and overseen more than $150 million in high-ticket sales spanning the Bahamas cruise industry, e-commerce ventures, and national roofing campaigns.

A master of both phone and door-to-door sales, - exit strategies that maximize return while minimizing risk.

Noralma Vecilla CFO Executive

With a career spanning four decades,

Noralma Vecilla brings integrity and experience in corporate operations, immigration systems, and ethical wealth management.

In her mid-60s, she continues to lead with structure and strategy.

She has implemented operational frameworks for construction and property management companies and collaborated extensively with attorneys specializing in immigration, legacy planning, and criminal law.

Her achievements include developing legacy-driven investment models tailored for high-net-worth clients.

Mark Jones

(Business Development & Investor Relations)

Background: Mid 40's, Visionary Business consultant and co-founder of the largest black owned crowd funding portal.

A Master of both EXIT Strategies and regulation 506C pathways, SEC and FINRA expert, the go to hidden in plain sight Billionaire that always wants to the exit to be correct before the buy options are ever present.

Expert on doing SCRATCH PUB CO, and in creating liquidity events for below market value shares.

This is not about ONE PERSON its about getting you the correct Return on your investment

-- thats why we are a Battalion

Joseph Mera – Ecuadorian COO Executive

Background: In his early 30s, Joseph Mera represents the new generation of disciplined innovators.

With a foundation in real estate acquisition, private funding coordination, and brand incubation, he has been instrumental in expanding Battalion Holdings’ footprint in South American and U.S. growth markets.

His achievements include structuring multi-property developments and managing diversified portfolios across technology, logistics, and entertainment. Known for his keen analytical foresight.

Grigory Livshits – Russian American (Telecommunications & Infrastructure)

Background: Born in Moscow with experience for 3 decades in NYC now based in Hollywood, Florida, Grigory Livshits brings over 25 years of international business leadership to Battalion Holdings.

With an MBA and a diverse portfolio of over 30 managed corporations, his experience spans telecommunications, security systems, construction, and global infrastructure development. Grigory is known for his methodical leadership, cross-sector synergy building, and corporate governance expertise, ensuring each enterprise operates with disciplined growth and sustainable profitability.

Jhoan Steven Cortez

(Cross-Border Funding & Investor Relations)

Background: With extensive experience in corporate funding and cross-border business development, Jhoan Stephen Cortez has cultivated partnerships with accredited investors throughout the Americas.

In his late 30s, his leadership has resulted in over $30 million in investor-backed capital raises, positioning him as a strategic connector between institutional investors and global opportunities.

Cortez is recognized for his ability to close complex financial transactions, ensuring compliance, transparency, and sustainability within each funding structure.

Baruj Mackliff CEO of PRBE CapitaL

At the helm of Battalion Holdings stands Baruj Mackliff, a citizen of the world - credit and capital strategist with a decade-long background in construction, funding, and corporate finance.

Starting his professional journey at just eight years old in South America, Baruj embodies the principle of earned excellence.

Today, in his early 30s, he leads PRBE Capital and Battalion Holdings Group, specializing in business credit structuring, 0% APR funding sequences, and strategic lending architectures.

He has helped 200+ startups and corporate clients secure over $20 million in capital, designing systems that merge compliance, scalability, and investor trust.

His leadership combines tactical precision with a commitment to ethical wealth creation and operational integrity.

✨ Why Work With Us ✨

“Preparation builds confidence. Confidence shapes excellence. Excellence sustains control. Control mitigates risk.”

This principle is more than a statement — it is the operational foundation upon which Battalion Holdings Group Inc. executes every investment, acquisition, and venture.

💳 From Solid Bricks to Silver Screens.

🏗️ Invest in Real Estate. Fund a Revolution. Where Wall Street Meets Main Street Morals..

Still Have Questions and you like too read?

Relax We have you Covered ! ! !

🏗️ Wait, so what does your company actually do? Are you a real estate company or an entertainment company? 🎬

BOTH. We're a real estate company that's FUNDING an entertainment empire. Here’s the master plan:

STEP 1: The Cash Flow Machine (WE ARE HERE) 🏢💰 We build next-generation apartment buildings in Orlando (like Battalion Residences) that are engineered to print money. Our "Rent-to-Equity" model, diversified income streams, and convertible notes for investors create a powerful, predictable cash flow machine. This isn't just real estate; it's a financial engine.

STEP 2: The War Chest 🏦🎯 The massive, stable profits from our real estate ecosystem provide the capital to launch our entertainment division. This means we don't have to beg Hollywood studios or take crappy deals. We fund our own projects with our own money.

STEP 3: The Takeover 🎥🍿

We use that war chest to produce high-quality films and series. Our goal isn't to just make movies; it's to build a streaming platform that can compete with the giants. We're building the future of independent entertainment, powered by the rock-solid foundation of real estate.

2. 🌀😬 Florida / Orlando's market can get crazy. How are you protecting my cash from a slowdown? 💵

We got a 3-layer armor plan for your investment: Diversified Cash Flow: Rent is only ONE of our 7 income streams.

If the rental market hiccups, our club memberships, premium wifi, and other services keep the money flowing. 💵➡️

💵 Sticky Tenants: Our "Rent-to-Credit" program builds our residents' credit scores.

They LOVE us and don't leave! ❤️📈 Low vacancy = stable income for YOU.

Pre-Sold Units: We're signing corporate housing deals RIGHT NOW. A huge chunk of this building is already SOLD before it's built. 📝✅ Your risk is GONE.

3. 🤷♂️ Explain this "Convertible Note" thing. Why is it better than just getting equity? 💡

Think of it as your VIP Profit Key. 🗝️

🎁 Step 1: You get paid 8-12% CASH every year, like a bond.

🤑 Step 2: After a few years, you can SMASH the "convert" button and turn your note into equity shares at a 20% DISCOUNT! 🏷️

👉 That's an instant profit machine built right in. You get safety + crazy upside. It's the holy grail.

4. 🔒 My money always gets stuck in real estate for 10+ years. What's your exit? ⏳

WE HATE THAT TOO! 🙅♂️ Our game plan is to refinance in Year 5 and give you back 60-70% of your initial investment. 🤑🔄 That means you get most of your cash back in just 5 years, not 10! The rest of your investment keeps printing money. It's a game-changer.

5. THE BOTTOM LINE: ⏳

You're not just investing in apartments. You're getting in on the ground floor of a media conglomerate. Your investment in our real estate today buys you a piece of our studio and streaming service tomorrow. We're building a legacy. Your money builds the buildings, and the buildings fund the dreams. 🚀🌟

6. 💵 What's my exit? When do I see my money from this? 🕒

👉 ✅ We've built multiple exits right into the plan:

Short-Term: Get high annual cash yields (8-12%) from the real estate profits starting in Year 2. 🤑

Mid-Term: Get a majority of your initial investment back in ~5 years when we refinance the properties. 🔄

Long-Term (The Jackpot): Hold your stock in the publicly traded Battalion Holdings.

As our real estate empire grows and Battalion Studios starts dropping films, the stock value skyrockets. This is where generational wealth is made. 📈🚀

7. 🎯 What's the REAL end game here? This seems bigger than just apartments. 🚀

You're right. This is a 3-Step Rocket Ship:

Step 1: The Cash Engine 🏢💸 We're building three multi-family deals (the $1.8M projects) to prove our money-printing model. This creates instant cash flow and a killer track record.

Step 2: The $100M Fund 🦈💰 We use that success to launch a $100M fund via a PPM (Private Placement Memorandum). This massive fund lets us scale the real estate empire FAST and sets us up to take the company PUBLIC.

Step 3: The Hollywood Takeover 🎬🍿

Once we're a publicly traded company on the stock market, we use that power and capital to launch Battalion Studios. Our goal? To finance and produce major films and compete with the big streaming platforms. Your real estate investment buys you a front-row seat to the studio.

8. 🎬 What kind of films will Battalion Studios eventually actually make? ✨

We will produce films that build people's values up, take them out of depression, and suicide attempts, instead of tearing society down. In a market saturated with content that demoralizes men, objectifies women, and mocks faith in God or Jesus Christ.

We will provide a compelling alternative, CINEMATIC ENIGMA BASED FILMS:

WAR, cyberpunk themes, ai themes, Biblical themes, history, and real life stories. --- Will be built on three pillars:

🛡️ Restoring the Archetype of Strong, Noble Masculinity. 👨👧👦🛡️ Our stories will feature men as protectors, providers, and virtuous leaders—not as fools or villains. We will make films that fathers are proud to watch with their sons.

❤️ Portraying Women with Dignity and Depth. 👩🌾❤️ We will create female characters who are strong, smart, and moral—respected for their character and wisdom, not valued OR PRAISED FOR BEING promiscuos. for their sexuality. We won't make "sluts" or "whores"; we'll portray heroes, mothers, innovators, and leaders. Upholding a Biblical Worldview.

🙏📖

Our stories will reflect the truth that good is good and bad is bad. They will be family-friendly, celebrate redemption, and provide meaning—without being preachy. 📖 🙏 We are the antidote to the "endless loop of calling good evil and evil good." 📖

9. ⚔️ How do I actually start investing with you? What's the process? 📲

💰 The process is built on personal connection and strategic alignment, not automated online forms.

Here's how we roll: Schedule a Call:

We start with a simple Zoom or phone call. You'll answer a few basic intake questions.

💰 The 10-Minute Strategy Session: You'll sit down (virtually) with CEO Baruj Mackliff or a senior Battalion representative for a focused, 10-minute conversation about your goals.

💰 The Right Path: We determine the perfect fit for your portfolio—whether it's our real estate deals, the future fund, or another opportunity through our network of banks and private investors.

🏦💰 The Battalion Reviews: Our entire team ("the battalion") ⚔️ reviews your case to match you with the absolute best funding or investment opportunity for your needs.

10. 🎯 This is not "fast money."

We operate with a long-term vision for your success 💵 & the success of our mission.

We're building empires, not chasing quick flips. 🕒

Office Hours:

Monday to Friday

11:30am - 7pm (Eastern time)

9:30am - 4pm (PST)

*Closed on Weekends*

299 Broadway suite 620

New York, NY 10007

📞 Call Battallion Holding Group:

Business Email: info@battalionholdings.org

Business Landline: +1 800-771-2631

📞 SMS +1 872-341-7071

COPYRIGHT © 2026 – BATTALION HOLDINGS Group INC – ALL RIGHTS RESERVED.

Battalion Holdings is a consulting and project management firm and not a direct lender or registered broker-dealer. All funding and investment opportunities are presented on behalf of third-party entities. No Guarantees: Battalion Holdings does not guarantee funding approval, specific investment returns, interest rates, or funding timelines. All financial projections, including references to IRR, equity multiples, and revenue targets, are hypothetical and based on good faith estimates. Past performance is not indicative of future results. 506(c) Offering Disclosure: Securities offerings are conducted under Rule 506(c) of Regulation D of the Securities Act of 1933, as amended. These offerings are available only to "Accredited Investors" as defined by the SEC. General Solicitation: This communication may constitute a general solicitation. Verification of Accredited Investor Status: We will take reasonable steps to verify your status as an Accredited Investor, which may include reviewing documentation such as tax returns, bank statements, brokerage statements, and credit reports. No Public Trading: These securities are not registered with the SEC or any state securities regulator and are offered in reliance on exemptions from registration. They are illiquid and cannot be readily sold or transferred. There is no public market for these securities. High-Risk Investment Warning: Investing in real estate development and private securities offerings involves a high degree of risk, including the potential for the loss of your entire investment. These investments are suitable only for persons who can afford to sustain such a loss. Consult Your Advisors: Prospective investors are strongly advised to consult with their own legal, tax, and financial advisors prior to making any investment decision. Intellectual Property: All consulting sessions, business models, investment memorandums, and materials are the confidential intellectual property of Battalion Holdings and may not be duplicated, shared, or resold without written consent. Third-Party Platforms: This website and its content are not affiliated with or endorsed by Facebook, Google, or any other third-party platforms. All product names, logos, and brands are property of their respective owners.

Contact: 📧 EMAIL: info@battalionholdings.org 📞 PHONE: 1 (800) 771-2631 | 1 (872) 341-7071 📞 WEBSITE: www.battalionholdings.org

Powered By Economic Battallion Capital

Powered By Economic Battallion Capital